If you are starting a business in India, having a PAN card for your business is mandatory. Whether it’s a private limited company, partnership firm, proprietorship, or LLP — a business PAN card is needed for taxation, GST, opening a current bank account, and more.

This guide will help you understand how to apply for business PAN card online, required documents, fees, and other important details in simple words.

✅ What is a Business PAN Card?

A Business PAN Card is a Permanent Account Number issued to a business entity by the Income Tax Department. It helps in:

- Filing business tax returns

- Applying for GST number

- Opening a current account

- Receiving payments above ₹50,000

- Business loan and credit application

📌 If you already have a PAN and want to check its status or verify details, visit our PAN card verification page.

📲 Who Needs a Business PAN Card?

If you run or plan to register any of the following, you need a business PAN:

- ✅ Proprietorship (if business name is different from your personal name)

- ✅ Partnership Firm

- ✅ Private Limited Company

- ✅ LLP (Limited Liability Partnership)

- ✅ Trusts, NGOs, Societies

- ✅ HUF (Hindu Undivided Family)

💻 How to Apply Business PAN Card Online?

Follow these simple steps to apply for a business PAN card online in India:

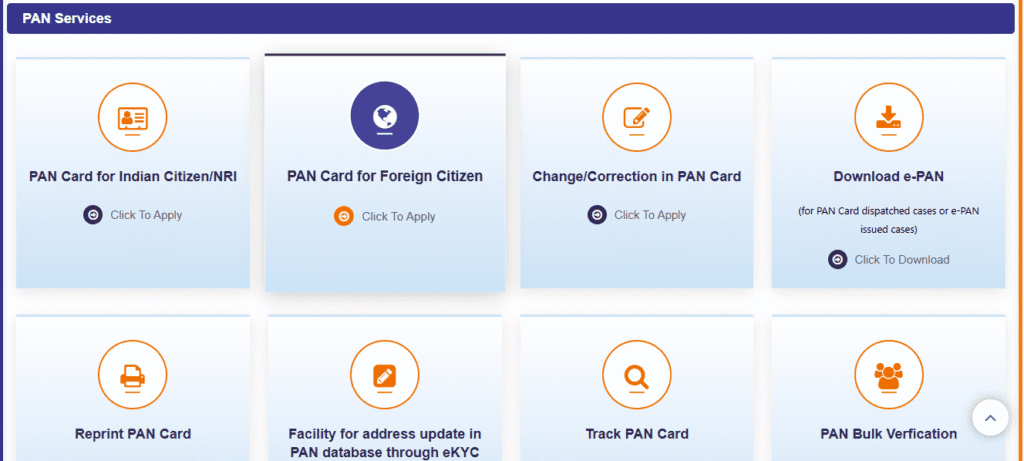

✅ Step 1: Visit the UTIITSL PAN Portal

Go to:

👉 https://www.pan.utiitsl.com/PAN/

This is the official UTI Infrastructure Technology And Services Limited (UTIITSL) site.

👉 Then Click on PAN Card for Indian Citizen/NRI form the showing options.

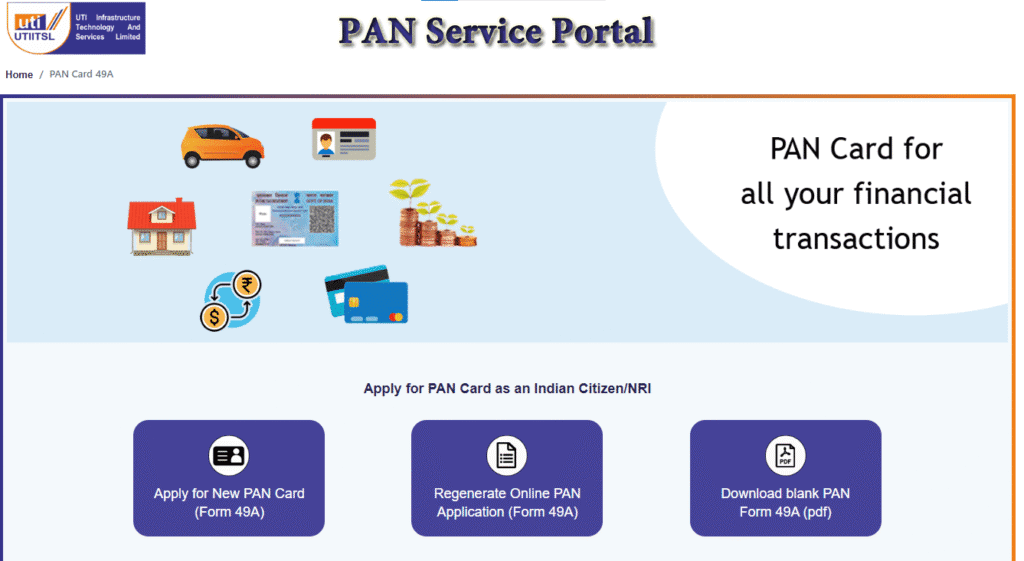

✅ Step 2: Select the Correct Form

On the next page Click on – Apply for New Card (Form 49A)

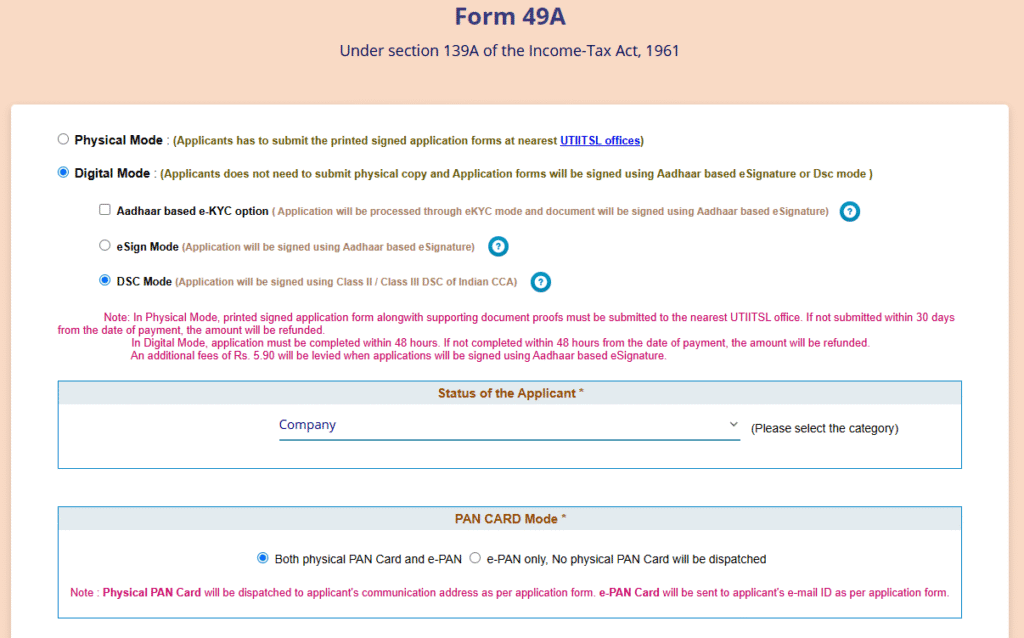

✅ Step 3: Select PAN Card Options

- Select Digital Mode Option.

- Under Digital Mode Select DSC Mode for Company / for other type of business choose as you prefered.

- For Category, select the correct business type —

like Company, Partnership Firm, LLP, Trust, or Firm.(Example: If you registered as a Pvt Ltd company, select Company.) - Select your prefered PAN card Mode from Both or e-PAN Only.

✅ Step 4: Fill in Business and Other Details

In the next page enter details like:

- Business name (as per registration)

- Date of incorporation

- Registration number (from ROC or partnership deed)

- Official business address

- Business phone number and email ID

👉 Make sure all details match your official documents.

✅ Step 5: Upload Required Documents

You’ll need to upload scanned copies of:

- Business registration certificate

- Proof of address (like electricity bill, rent agreement)

- Identity proof of authorized signatory (like Aadhaar card)

- Passport-size photograph of the authorized signatory

💡 Real-life tip:

If you are running a shop, firm, or startup, use your registration paper from the local authority or MSME certificate as proof.

✅ Step 6: Make Payment

Pay the fee online using UPI, debit card, credit card, or net banking.

For Indian addresses, the fee is usually around ₹110.

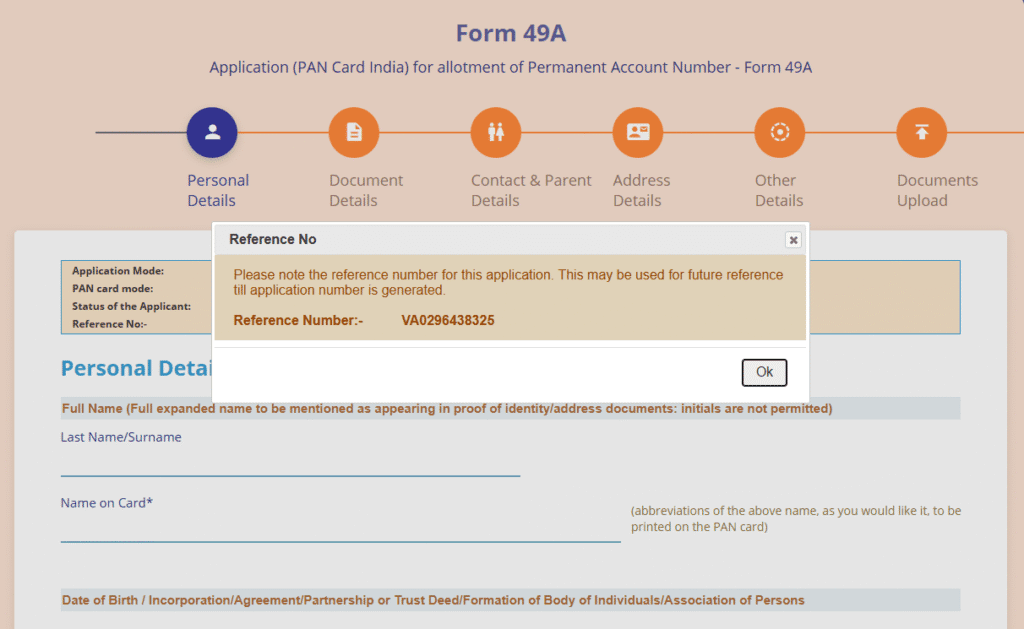

✅ Step 7: Submit and Note the Acknowledgment Number

After payment:

- You will get an acknowledgment slip with a number.

- Download and save it — you can use it later to track your application.

✅ Step 8: Send Physical Documents (if needed)

For some business types, you may need to send the signed acknowledgment and documents to the NSDL office by post.

Check the instructions on the acknowledgment slip.

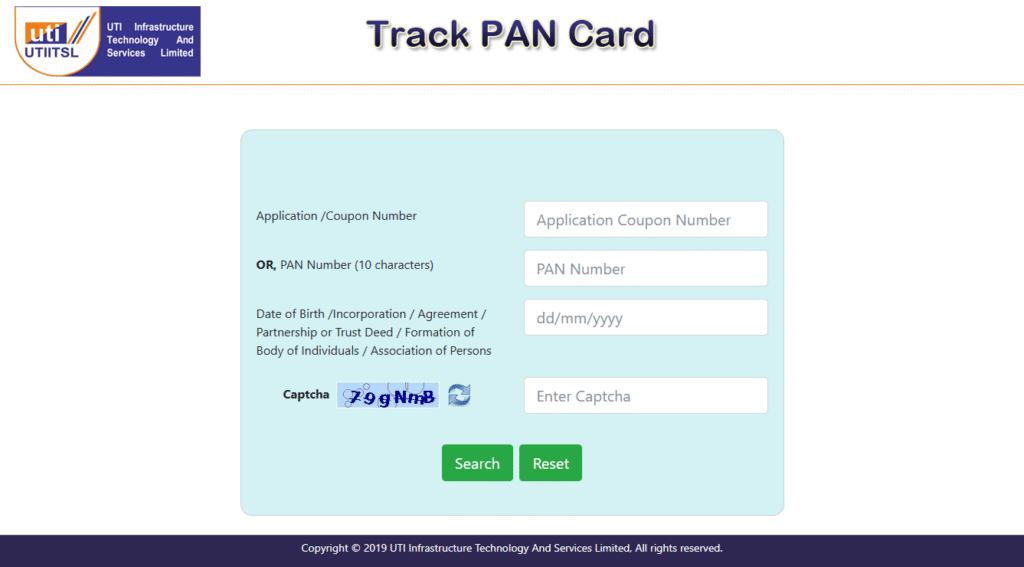

✅ Step 9: Track Your Application

Go to:

👉 https://www.trackpan.utiitsl.com/PANONLINE/#forward

Enter your acknowledgment number and captcha code to track progress.

Usually, you will get your Business PAN Card in 15-20 days.

✅ Need help with PAN-Aadhaar linking? Check our guide on how to link Aadhaar to PAN card online.

📄 Documents Required for Business PAN Card.

Here are the documents you’ll need, depending on the type of business:

For Partnership Firm:

- Partnership deed

- ID proof & address proof of partners

For Private Limited Company:

- Certificate of Incorporation

- Company registration proof (MCA)

- Director’s ID & address proof

For LLP:

- LLP Agreement

- Certificate of registration

- Partner details

For Sole Proprietorship:

- Any registration certificate of business in the business name

- ID and address proof of the proprietor

🕒 How Much Time Does It Take?

Once you apply online, you will get the PAN number within 7 to 10 working days. You can also opt for e-PAN, which is sent by email and can be used immediately.

💸 Application Fee for Business PAN Card.

| Type of Address | Fee (₹) |

|---|---|

| Indian Communication Address | ₹110 (including GST) |

| Foreign Communication Address | ₹1,020 (including GST) |

You can pay via debit/credit card, UPI, or net banking.

🔍 How to Check Business PAN Card Status?

After applying, you can track the status by entering your acknowledgment number here:

👉 https://tin.tin.nsdl.com/pantan/StatusTrack.html

Or read our full guide on PAN verification and status check.